USA

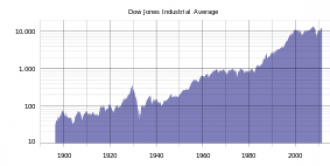

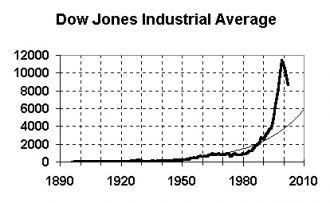

Back in 1896, all Charles Dow needed was a pencil and paper to compute the industrial average. He simply added up the prices of the twelve stocks and then divided by 12. In 1923, the task of working the numbers fell to Arthur "Pop" Harris, who had been hired in 1908 at the age of 22.

In 1896, when Charles Dow scribbled his first simple calculation, no one could have imagined that over the next century his "averages" would become the key benchmark to the nation's economy. For the next 40 years, Pop calculated the Dow Jones average every hour on the hour for the Dow Jones News Service. On busy trading days, he sometimes bloodied his hands pulling out the ticker tape. Through all those years, the financial world would hold its breath for seven minutes after the New York Stock Exchange's closing bell, waiting for Pop, who was a small, skinny man, to finish his official calculations on a piece of newsprint.

Pop Harris retired in 1963, and by then the advent of computers made it possible to calculate the Dow Jones averages in a fraction of a second any time of the day. Today, the first step in calculating The Dow is still totaling the prices of the component stocks. But the rest of the math isn't so easy anymore, because the divisor is continually being adjusted. The reason? To preserve historical continuity. In the past hundred-plus years, there have been many stock splits, spinoffs and stock substitutions that, without adjustment, would distort the value of the Dow. To understand how the formula works, consider a stock split. Say three stocks are trading at $15, $20 and $25; the average of the three is $20. But if the company with the $20 stock has a two-for-one split, its shares suddenly are priced at half of their previous level. That's not to say the value of the investment has changed; rather, the $20 stock simply sells for $10, with twice as many shares available. The average of the three stocks, meanwhile, falls to $16.66. So, The Dow divisor is adjusted to keep the average at $20 and reflect the continuing value of the investment represented by the gauge.

Over time, the divisor has been adjusted several times, mostly downward (it stood at 0.125552709 at the end of 2008), which means that it has become, in effect, a multiplier. This explains why the average can be reported as, say, 9800, even though the sum of all 30 stock prices is nowhere close to that number. A one-point move in any component stock pushed the average up or down almost eight points at the end of 2008.

"What the divisor does is keep things level with history" says Robert Dickey, a technical stock analyst at Minneapolis-based Dain Rauscher Inc. Current divisors for each of the Dow Jones averages appear on page C4 of The Wall Street Journal every day.

In another effort to preserve continuity, the guardians of the Dow keep to a minimum any changes in the index's component stocks. Most substitutions have arisen because of mergers. From time to time, changes also are made to keep The Dow representative of the broad market, which itself shifts in composition.

As the economy has moved from railroads to heavy industry to consumer goods to technology over the past century, the Dow's component stocks have reflected those changes. Yesteryear's components, such as Bethlehem Steel Corp., Westinghouse Electric Corp. and Woolworth Corp., have given way to Hewlett-Packard Co., Johnson & Johnson, Microsoft Corp. and Wal-Mart Stores Inc.

Since Charles Dow's time, several stock-market indices have challenged the Dow Jones Industrial Average. In 1926, Standard Statistics Co., a predecessor of today's Standard & Poor's Corp., developed a 90-stock index that by the 1950s had evolved into the S&P 500, a benchmark widely used today by professional money managers. Today, there are thousands of indices, tracking everything from broad markets to tiny slivers to investment strategies.

Source: https://www.djaverages.com/?go=industrial-calculation

USA,

USA,